ACA 2025: Understanding the Latest Updates & What They Mean for You

Decoding the Latest Updates to the Affordable Care Act (ACA) in 2025 involves understanding key changes to subsidies, eligibility, and coverage options, ensuring individuals and families can navigate the healthcare landscape effectively and access affordable insurance plans.

Navigating the complexities of healthcare can be daunting, especially with ongoing changes to legislation. Let’s break down the latest updates to the Affordable Care Act (ACA) in 2025: What You Need to Know, offering clear insights and practical advice.

Understanding the Affordable Care Act: A Brief Overview

The Affordable Care Act (ACA), also known as Obamacare, has been a cornerstone of US healthcare policy for over a decade. It aims to make health insurance more accessible and affordable for all Americans. Let’s delve into its core principles.

The ACA was enacted to address significant issues within the healthcare system, such as lack of coverage for pre-existing conditions and high uninsured rates.

Key Objectives of the ACA

The ACA pursues several key objectives to reform the healthcare landscape:

- Expanding Health Insurance Coverage: Aims to reduce the number of uninsured Americans by providing subsidies and establishing health insurance marketplaces.

- Protecting Consumers: Implements regulations that prevent insurance companies from denying coverage based on pre-existing conditions and setting annual coverage limits.

- Improving Healthcare Quality: Focuses on preventive care and chronic disease management to enhance overall health outcomes.

The ACA’s impact has been substantial, leading to millions gaining health insurance coverage and benefiting from consumer protections.

Significant Changes Expected in 2025

As we move into 2025, several significant changes to the ACA are anticipated. Understanding these updates is crucial for both current enrollees and those considering joining the health insurance marketplace. We’ll break down what to expect.

These changes aim to refine the ACA’s functionality and address ongoing challenges in healthcare affordability and accessibility.

Potential Adjustments to Subsidies

One of the primary areas of focus is the potential adjustments to subsidies:

- Income Thresholds: Changes in income thresholds for subsidy eligibility, potentially expanding access to more individuals and families.

- Subsidy Amounts: Adjustments to the amount of financial assistance available, impacting the affordability of health insurance plans.

- Premium Tax Credits: Updates to the premium tax credits, which help lower monthly premiums for eligible enrollees.

Keep an eye on these changes, as they could significantly impact your healthcare costs in 2025.

These subsidies play a vital role in making health insurance accessible to those who need it most.

Eligibility Criteria: Who Qualifies?

Understanding the eligibility criteria for ACA coverage is fundamental. These criteria determine who can enroll in marketplace plans and receive financial assistance. Let’s define the key factors.

Eligibility is based on factors such as income, household size, and access to other forms of health insurance.

Income Requirements

Income is a major determinant of eligibility:

- Federal Poverty Level (FPL): The ACA uses the FPL to determine eligibility for subsidies; those with incomes between 100% and 400% of the FPL may qualify for premium tax credits.

- Income Verification: Enrollees are required to verify their income during the application process, ensuring accurate subsidy calculations.

Meeting these income requirements is crucial for securing affordable healthcare coverage.

The Federal Poverty Level is updated annually, so stay informed about the latest thresholds.

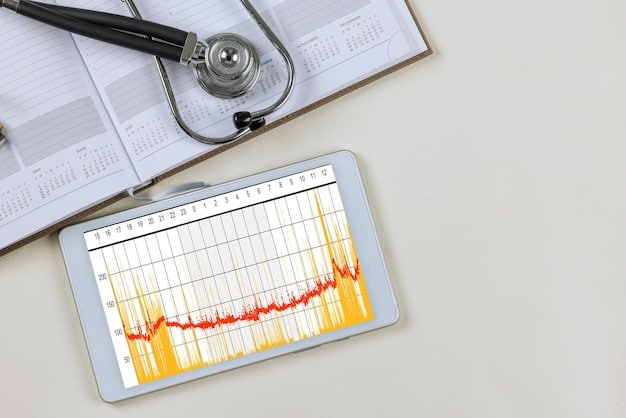

Navigating the Health Insurance Marketplace

The health insurance marketplace is the primary platform for enrolling in ACA plans. Understanding how to navigate this marketplace effectively is essential for finding the right coverage. Let’s discuss how to do so.

The marketplace offers a variety of plans, allowing individuals to compare options and choose the one that best fits their needs and budget.

Tips for Choosing the Right Plan

Selecting the right plan involves considering several factors:

- Understanding Plan Tiers: Familiarize yourself with the different plan tiers (Bronze, Silver, Gold, Platinum) and their respective cost-sharing structures.

- Comparing Coverage Options: Evaluate the coverage benefits, including deductibles, co-pays, and out-of-pocket maximums.

- Checking Provider Networks: Ensure that your preferred doctors and hospitals are included in the plan’s network.

Taking the time to compare plans can help you find the best value for your healthcare needs.

Impact on Different Demographics

The ACA has different impacts on various demographic groups. Understanding these nuances is crucial for tailoring coverage options to specific needs. We’ll uncover how it affects each population.

Different age groups, income levels, and family structures may experience varying benefits and challenges under the ACA.

Young Adults

Young adults benefit from the ACA in several ways:

Young adults can stay on their parents’ health insurance plans until age 26, providing coverage during a critical transitional period. Additionally, the ACA offers affordable coverage options through the marketplace, addressing the often-limited access to employer-sponsored insurance for this demographic.

Families

Families also gain significant advantages from the ACA:

Families benefit from the ACA’s subsidies and coverage options, making it easier to afford health insurance for all family members. The ACA also ensures access to essential health benefits, including pediatric care and maternity services, promoting the well-being of both parents and children.

Overall, the ACA aims to provide comprehensive support for families, ensuring access to quality healthcare services and financial assistance when needed.

Future of the ACA: Challenges and Opportunities

The Affordable Care Act continues to evolve, facing ongoing challenges and potential opportunities. Understanding these dynamics is crucial for anticipating future changes and ensuring the ACA’s long-term viability. Let’s discuss the outlook.

Political debates, legal challenges, and evolving healthcare needs will shape the future of the ACA.

Potential Legislative Changes

Legislative changes could significantly impact the ACA:

- Repeal Efforts: Attempts to repeal or replace the ACA could alter the fundamental structure of the healthcare system.

- Amendments and Adjustments: Amendments to the ACA could refine its provisions, addressing specific issues or improving its effectiveness.

Staying informed about legislative developments is essential for understanding the future of the ACA.

Advocacy and public engagement play a vital role in shaping healthcare policy.

In summary, the ACA continues to be a vital part of the US healthcare system, providing coverage and protections to millions. Staying informed about changes and understanding your options can help you navigate the healthcare landscape effectively.

| Key Aspect | Brief Description |

|---|---|

| 💰 Subsidies | Adjustments to income thresholds and subsidy amounts, affecting premium costs. |

| ✅ Eligibility | Requirements based on income, household size, and access to other insurance. |

| 🛒 Marketplace | Platform for comparing plans, understanding tiers, and checking provider networks. |

| 👪 Demographics | Varying impacts on young adults, families, and different income levels. |

Frequently Asked Questions (FAQ)

▼

The ACA prohibits insurance companies from denying coverage or charging higher premiums based on pre-existing conditions. This ensures that individuals with chronic illnesses can access the healthcare they need without discrimination.

▼

ACA plans cover a range of essential health benefits, including ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, and preventive care.

▼

You can apply for ACA health insurance through the Health Insurance Marketplace during the open enrollment period. Navigate to HealthCare.gov, create an account, and complete the application process to determine your eligibility for subsidies and plan options.

▼

Report any income changes to the Health Insurance Marketplace as soon as possible. Your subsidy amount may be adjusted based on these changes, which could affect your monthly premium. Keeping your information up-to-date helps avoid discrepancies.

▼

While there is no longer a federal penalty for not having health insurance, being uninsured can leave you vulnerable to high medical costs in the event of an illness or injury. Exploring ACA plans can provide affordable options for coverage.

Conclusion

Staying informed about the latest updates to the Affordable Care Act (ACA) is crucial for making informed decisions about your healthcare. By understanding the changes, eligibility criteria, and available resources, you can navigate the health insurance landscape effectively and ensure access to the coverage you need.